US Steel and Nippon Steel have filed a lawsuit against President Biden, challenging his decision to block their $14.9 billion merger. The companies allege that the President’s order violates their constitutional right to due process and breaches statutory procedural requirements, further claiming it reflects unlawful political influence. The lawsuit, filed in the US Court of Appeals for the District of Columbia Circuit, seeks to overturn both the Committee on Foreign Investment in the United States (CFIUS) review process and Biden’s blocking order.

A second lawsuit accompanies the first, targeting Cleveland-Cliffs, its CEO Lourenco Goncalves, and United Steelworkers union president David McCall. These defendants are accused of illegal and coordinated actions designed to obstruct the merger. President Biden’s decision, announced last week, followed a year-long review and effectively terminated the acquisition plan. Despite Nippon Steel’s winning bid in December 2023 – outcompeting significant players such as Cleveland-Cliffs, ArcelorMittal, and Nucor – political and union opposition ultimately proved insurmountable.

The deal faced significant headwinds from both President Biden and Donald Trump, the latter poised to assume office later this month. The White House expressed serious national security concerns, citing US Steel’s crucial role in producing materials vital to national defense. Internal disagreements within CFIUS ultimately led to the President’s intervention. Prior to the block, the Biden administration privately communicated to Nippon Steel that the merger posed a national security risk, potentially damaging the US steel industry.

US Steel had warned that the deal’s failure would jeopardize thousands of union jobs and potentially lead to plant closures, even suggesting a relocation of its headquarters from Pennsylvania. Despite overwhelming shareholder approval in April 2024, and concessions offered by Nippon Steel – including relocating its US headquarters to Pittsburgh and upholding existing agreements with the United Steelworkers – the deal ultimately faltered. The stock price consistently failed to reach the $55 per share offer price, highlighting investor apprehension regarding the deal’s future.

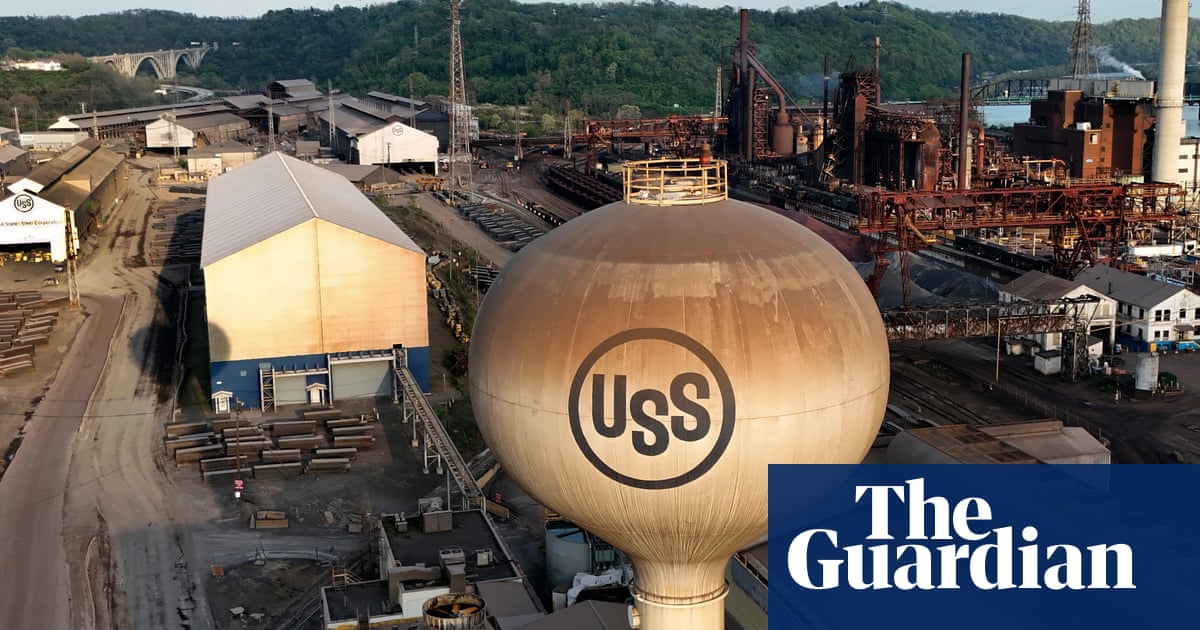

US Steel, a historical giant founded in 1901 by industrial titans like Andrew Carnegie and J.P. Morgan, played a significant role in post-Depression and post-World War II American industrial recovery. However, recent financial challenges, including declining revenue and profits, made the company an attractive acquisition target. This lawsuit marks a significant legal challenge to presidential authority in reviewing foreign investments and raises key questions about the balance between national security concerns and private business transactions.